How to pull your own retirement data

As the aging population grows in your area, you want to find out the average income of that growing market. If you were to need this data for the entire US or an entire state, you'd likely want to use the Census' Current Population Survey to pull data like social security and retirement income. But you don't want data for large geographies. You need it by zip code. You have two options.

How to use the U.S. Census to find retirement income by zip code

ABOUT THE AMERICAN COMMUNITY SURVEY

You are probably familiar with the Decennial Census that counts each US resident every 10 years. But you might not know that the same agency that collects the Decennial Census, the US Census Bureau, also surveys a subset of the population every year. This annual survey is called The American Community Survey (ACS) and targets over 3.5 million households every year to gather basic information such as age, sex, race, and retirement income. See where we are going here?

The ACS is updated every year, and the most current data available is from 2023. The 2024 data set will be available in December of 2025. Before you dismiss this data as "too old" (a phrase those retirees won't like either), remember that before 2005 we only received updated Census data every 10 years. If you are looking for more current retirement data, you will have to buy estimates from a private data company.

Let's look at the data supplied by the ACS, what it means, and how it can be useful for you.

The ACS collects tons of income data, but the three income types below have a little something in common (as in, getting paid to take it easy) and will prove useful in your search:

RETIREMENT INCOME Regular income from a company pension, union pension, Federal government pension, state government pension, local government pension, U.S. military pension, KEOGH retirement plan, SEP (Simplified Employee Pension) or any other type of pension, retirement account or annuity such as IRA, ROTH IRA, 401(k) or 403(b).

SOCIAL SECURITY INCOME (SI) Social Security income includes Social Security and U.S. railroad retirement pen- sions and survivor benefits, permanent disability insurance payments made by the Social Security Administration prior to deductions for medical insurance, and railroad retirement insurance checks from the U.S. government. Medi- care reimbursements are not included.

SUPPLEMENTARY SECURITY INCOME (SSI) Supplemental Security Income (SSI) is a nationwide U.S. assistance program administered by the Social Security Administration that guarantees a minimum level of income for needy aged, blind, or disabled individuals.

USING THE AMERICAN COMMUNITY SURVEY

On Census.gov, you'll need to download two different tables for each income type to calculate your average retirement income by zip code.

(1) AGGREGATE TABLE The aggregate table includes the sum of all retirement income, all Social Security income or all Supplemental Social Security income received by all households in the zip code.

(2) UNIVERSE TABLE The universe table estimates of the number of households in that zip that have retirement income, Social Security income or Supplemental Social Security income.

THE FORMULA

Aggregate Amount

Universe Amount

=

Average Retirement Income

Then you'll divide the aggregate amount (1) by the universe amount (2) to calculate the (you guessed it) average retirement income (or SI or SSI) for your zip code. You can do this!

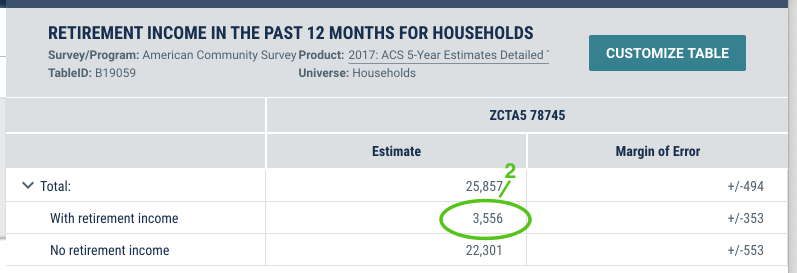

Let's look at an example. Here's what these two tables look on Census.gov for 78745 – our home zip code in Austin, Texas. Yeehaw!

In our example, we would divide (1) 88,982,500 by (2) 3,556 to find out that the average retirement income for 78745 is $25,023. Easy as (1)(2)...

Not so sure the Census is the way you want to collect and calculate your data? Don"t worry, there is a second option.

How to use IRS SOI data to find retirement income by zip code

ABOUT THE IRS SOI DATA

The second option for figuring out the average retirement income is using the IRS's SOI data.

The IRS's (Internal Revenue Service) SOI (Statistics of Income) has been in effect since The Revenue Act of 1916, which "mandated the annual publication of statistics related to 'the operations of the internal revenue laws'" and is a collection and sharing of data related to the tax system. Don't worry though, they don't share individual tax information, releas- ing that information is a (sometimes newsworthy) personal choice.

The most recent Individual Income Tax Zip Code data out there is from 2021. You may notice that this data is even older (no offense retirees!) than the ACS data. The 2022 data should be available in the spring of 2025.

Once you have downloaded the table you desire, you can find your specific Zip Codes (rows) and the specific retirement information you are looking for (columns). For average retirement income, the following columns could be useful:

TAXABLE INDIVIDUAL RETIREMENT ARRANGEMENT (IRA) DISTRIBUTIONS Distributions may be taken out of an IRA at any time, but a 10% tax is applied if a person is under 59 1⁄2 and an RMD (required minimum distribution) is required once a person is 70 1⁄2. RMD's are calculated by dividing the amount in the IRA by life expectancy.

PENSIONS AND ANNUITIES IN ADJUSTABLE GROSS INCOME (AGI) Taxable retirement income in the form of pensions and annuities.

TAXABLE SOCIAL SECURITY BENEFITS 50-85% of your Social Security Benefits are taxable depending on your combined income.

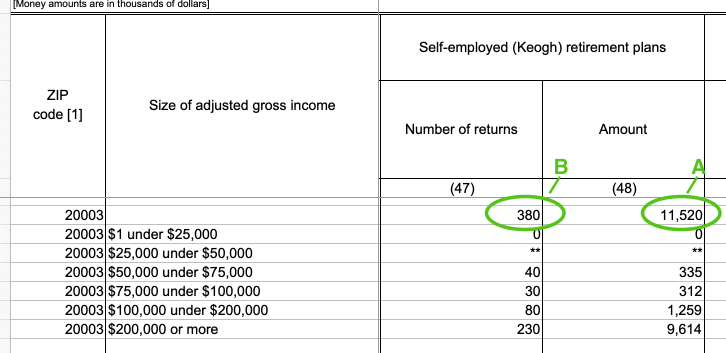

SELF-EMPLOYED (KEOGH) RETIREMENT PLANS A Keogh plan is a tax-deferred pension plan available to self-employed individuals or unincorporated businesses for retirement purposes.

NUMBER OF ELDERLY RETURNS Includes primary taxpayers 60 years of age or older.

See the number of returns filed for each income bracket by Zip Code. This is not necessarily retirement income but can give you an idea of the number of people over 60 in each income bracket.

USING THE IRS SOI DATA

You will need WinZip to extract the (rather large) data files, which will either encompass data for all the states (who needs space on their computer, right?) or can be dialed down to data from an individual state (which still has a LOT of data).

Here is an example of how to calculate the Average Self-employed (Keogh) retirement plans income for a specific zip code using SOI data where

(A) is the total dollar amount in thousands of dollars and

(B) are the total number of returns:

THE FORMULA

Total Dollar Amount (thousands)

Total Number of Returns

x1000 =

Average Retirement Income

So now, you know that the data are available from trustworthy data sources to calculate the average retirement income by zip code. But if you find yourself thinking: "Yeah, sure I could pull all of this data myself in a couple of days, but I have other important things to do and I really don't want to find the most current datasets, download them, reconfigure the layouts and calculate the averages," you are not alone. You sound just like our other clients who depend on us to provide clean, accurate and easy-to-work-with data as well as human-to-human customer support. You can get average retirement data, as well as hundreds of other data points, in a custom data pull. Prices start at $599 with a 2 business day turnaround. Tell me what data you need for which zip codes (all in the US versus all in one state) & I'll get you a free quote and turnaround time.